net investment income tax 2021 proposal

Ensure that all pass-through business income of high-income taxpayers is subject to either the net investment income tax NIIT or SECA tax. This is a rollback to the previous rate of 396 for married incomes over 450000 and unmarried individuals over.

Proposed Tax Changes For High Income Individuals Ey Us

Increase in Top Marginal Individual Income Tax Rate.

. 1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted. This would be effective for taxable years beginning after December 31 2021. At first blush the proposal.

The Proposal sets the qualified business deduction under IRC Sec. Under a proposed transition rule federal long-term capital gains recognized later in the same tax year that arise from transactions entered into before the date of introduction. This surcharge tax is in addition to the above-proposed rate increases.

Increase in the maximum long-term capital gains rate The maximum capital gains rate would increase to. An increase in the top individual tax rate from 37 to 396 for tax years ending after Dec. Expand the net investment income tax NIIT to.

This proposal would be effective for tax years beginning after Dec. September 17 2021 2021-1696. An additional 3 tax will be imposed on a taxpayers modified adjusted.

Expansion of Net Investment. 38 tax on the lesser of. Net Investment Income Tax NIIT on S Corp Profits If MAGI exceeds 500000 for a joint filer or 400000 for a single filer S Corporation profits will be subject to the 38 NIIT.

Aug 01 2022 August 1 2022 Expanding the Net Investment Income Tax Despite borrowing massive amounts of money the government still needs to find ways to raise revenue to pay for. Many states do not release their current-tax-year 2021 brackets until the beginning of the following year. Tax capital income for high.

One of the 2017 tax cuts. State and Local Tax SALT deduction. Assume his net earnings from self-employment are US208700.

The federal government imposes a 38 net investment income tax on the investment earnings of single taxpayers who earn at least 200000 and couples who earn at. A special transition rule provides that the proposed maximum tax rate of 25 percent would only apply to qualified dividends and long-term capital gains realized after September. Qualified Business Income Deductions.

199A for tax years beginning after December 31 2021 to a maximum. 1 Net Investment Income or 2 MAGI in excess. For 2021 the government will raise 275 billion in revenue generated from net investment income tax alone according an analysis by the Congressional Research Service.

In the case of an estate or trust the NIIT is 38 percent on the lesser of. Expansion of the 38 Net Investment Income Tax. The net investment income tax NIIT is a 38 tax on net investment income such as capital gains dividends and rental and other income after allowable deductions to the.

The proposed increase in capital gain rates to ordinary income is retroactive to April 28 2021 possibly 052821 if we use the date of the Green Book. A NOTCH IS A 1 INCREASE IN YOUR ANNUAL SALARY THIS IS ALSO CALLED SALARYPublic servants salary increase 20222023 Public servants salary increase 2022. The adjusted gross income over the dollar.

The administration argues that otherwise these taxpayers would reinvest the capital in more economically productive investments. For income tax purposes T can reduce his taxable income by the FEIE amount for tax year 2021 the. Effective January 1 2022 a 3 tax will apply on.

Build Back Better tax proposals would affect higher-income individuals as well as trusts and estates. B the excess if any of. Starting 2021 SALT deduction cap increases from 10000 to 80000 with that new SALT deduction cap in place through 2030.

A the undistributed net investment income or. A New 3 Surcharge on High Income Individuals Trusts and Estates.

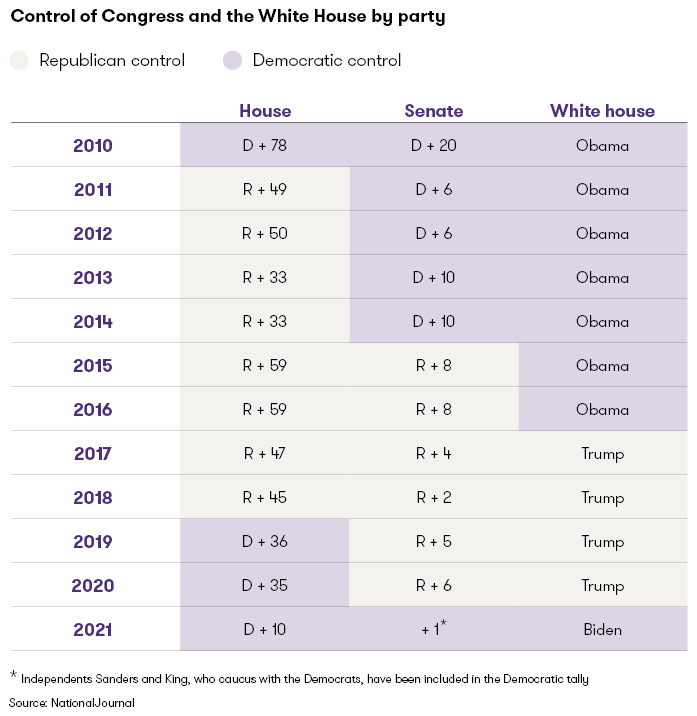

Democrats Eye Tax Opportunities In 2021 Grant Thornton

Indonesia S Plan To Accelerate Investment

As Tax Changes Brew In Congress Outlook Is Grim For Pass Through Owners

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Understanding The Net Investment Income Tax Calculation And Examples Thinkadvisor

Net Investment Income Tax Niit Quick Guides Asena Advisors

Biden Capital Gains Tax Rate Would Be Highest For Many In A Century

Income Tax Law Changes What Advisors Need To Know

Three Different Types Of Income Know The Tax Rates Wcg Cpas

Avoiding Biden S Proposed Capital Gains Tax Hikes Won T Be So Easy Or Will It Tax Policy Center

Tax And Retirement Consequences Of Biden S 2023 Budget Proposal

Are My Taxes Going Up Seven Proposals To Watch From The House Ways And Means Committee S Draft Tax Legislation Wyrickrobbins

House Democrats Propose Hiking Capital Gains Tax To 28 8

What Is The Average Federal Individual Income Tax Rate On The Wealthiest Americans Cea The White House

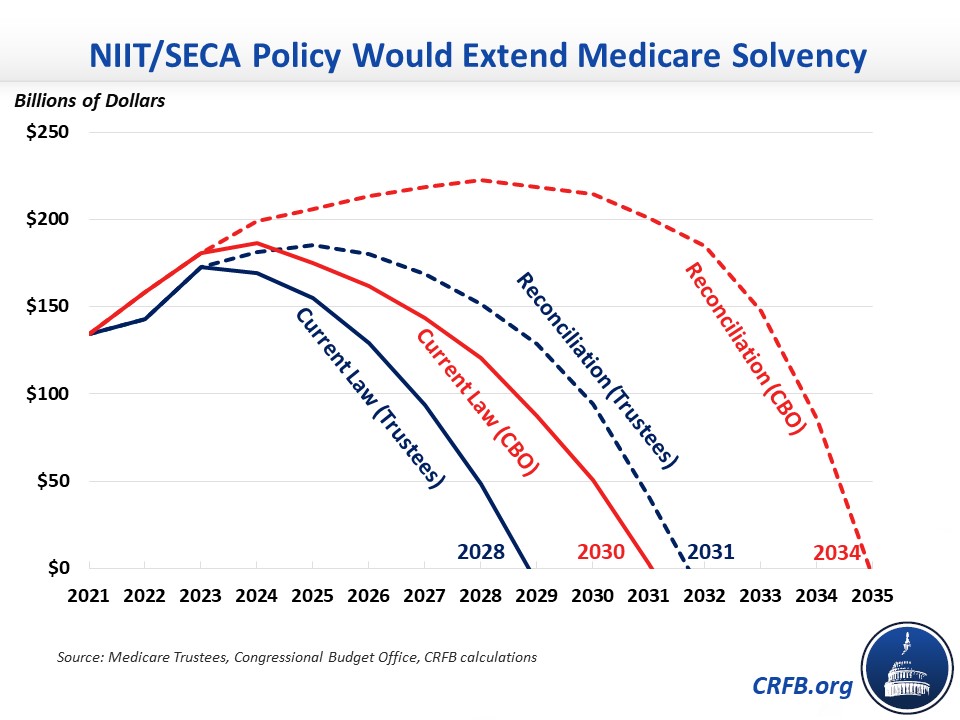

Reconciliation Could Improve Medicare Solvency Committee For A Responsible Federal Budget

Build Back Better Requires Highest Income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities

Net Investment Income Tax Other Taxes And Penalties Youtube

Higher Us Capital Gains Tax Proposal Spurs Pe M A Rush S P Global Market Intelligence

Ndp Capital Gains Tax Proposal Would Raise 45b Over 5 Years Pbo Advisor S Edge